Motorcycle riding is an exhilarating experience that demands attention to safety. At the forefront of rider protection stands the motorcycle helmet—a vital

What to look for searching for the handheld spotlights

What Speed Should I Use My DA Polisher?

When it comes to polishing your car, there’s a lot of debate over what speed you should use. Some people swear by

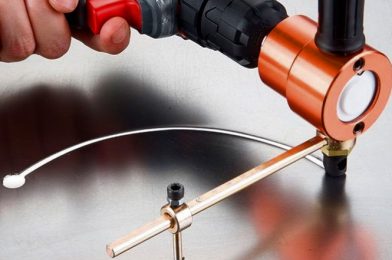

What are the metalworking tools you need to get started?

The metalworking tools are necessary for you to work when you stay back at your home and you plan to repair something

What are the different types of bandsaw blades?

If you have a look at the market you will be able to find a lot of varieties in the band saw

The budget metal nibbler buying guide

If you wanted to cut a metal sheet in an accurate way you need to make use of the best metal nibbler

How can you set up a press brake tool?

During the time of press brake set up, you need to have every part that will be included inside the tool.

Safety tips for working with metal

While you are working with the metal you have to be very much careful. If you do not know how to handle